Richard Mellor

Afscme Local 444, retired

GED/HEO

4-23-24

It is heartwarming to witness students at Yale, Harvard, Columbia and other US

universities protesting the Biden regime’s arming and overall support of the

horrific genocidal war against the Palestinian people and particularly in Gaza where

some 34,000 Palestinians have been killed with US weapons paid for by the US

taxpayer. The same taxpayer that needs to borrow money for health care.

The US mass media is attempting to paint the protests as anti-Semitic. The New

York Times and USA today makes the point that protesting the Gaza genocide or

criticism of Israel is an attack on the Jewish people and their religion;

according to these sources, Jews are in fear of their lives on College

campuses. “The pro-Palestinian student movement has disrupted campus life,

especially for Jewish students. Many have said they no longer feel safe in

their classrooms or on university quads as the tone of protests at times has

become threatening.”, writes thepro-Zionist New York Times.

But there is no evidence of this. This argument has been debunked by Jewish students, many of who are in the leadership of the protests. Simone Zimmerman, a co-founder of ifnotnow, aJewish organization that opposes the Israeli Apartheid regime and calls for a Cease Fire in Gaza wrote on X, formely Twitter:

“Spent the first night of Passover at the student seder in the Gaza solidarity encampment at Columbia. The Jewish flank of the Palestine solidarity movement is growing and it is so beautiful to behold. Judge for yourself how unsafe these Jewish students look.” Students at Columbia responded to the mass media's efforts to portray their protests as anti-Semitic at a live broadcast today. You can see that here.

As a retired union activist and socialist it is wonderful to witness these

developments. I was very moved watching the live press conference that the

Columbia students held today.

One young Jewish woman talked of her Jewish ancestors and her great grandfather who was in the Russian Revolution of 1905 fighting against the oppressive Tsarist regime that forced Jews to live in a certain area (the pale). She also talked of the Jewish Bund. She called it the Labor Bund. I was surprised as very few young Jews other than leftists have a clue what the Bund was.

The Zionists do not teach about the Bund which played such a hug erole in

Jewish life in Europe before the betrayal of Stalinism and the rise of Nazism.MOst Jewish workers belonged to the Bund. I've met Jewish Israeli tourists in the US and when I mention the Bund they have no

clue what I'm talking about. Joshua Freeman's book, Working Cass New York touches

on the Bund's role here in the US.

Another young woman, an Iranian Jew, was very powerful in her remarks and how her Jewish faith drives her to do what she is doing as part of the protests. It was so uplifting for me to watch it. One of the speakers, I can't recall which, explained how "Jewishness lives on with solidarity with the Palestinians"

Things are happening so fast it's difficult to determine what will happen next.

Columbia University's administration called the police on protestors and

hundreds were arrested and 120 were arrested on Monday at NYU.

However faculty have come out to defend students and there is increasing anger

at what is considered an assault on academic freedom.

The efforts of the Biden Administration and the US body politic to portray

these protests as anti Jewish or anti-Semitic is not faring well, made

difficult by the fact that so many young American Jews are in the forefront of

the movement. While in these initial stages, it seems that some Ivy League

universities are ahead of the game one wonders at what point public

universities with a more working class base or community colleges might enter

the fray.

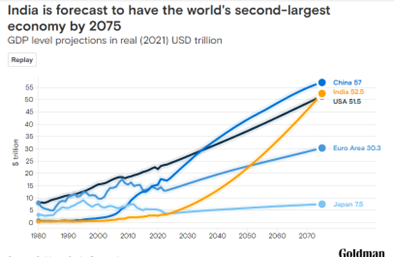

The prospect of a wider student movement arising is a major concern for the US

Congress which is overwhelmingly pro-Zionist for the reasons I have stated many

times. The Zionist regime is the only reliable ally the US has in the Middle

East and any defeat for the Zionist regime is a blow to US imperial power and

influence already under threat from China. The US support for Israel has

nothing to do with a love for Jews or preserving the Jewish identity; the US

ruling class is rife with anti-Semites.

Having said all this, it is without question that there are anti-Semites, Jew

haters, that will use the movement in support of the Palestinian cause and non

Jews in the movement in particular must give them no quarter. We must take them

up in the strongest manner possible. But the students and young people protesting at Columbia and

other universities, many of them Jewish, are on the right side of history and

their demands include divestment from Israel, and amnesty for the students and

faculty disciplined or arrested from the demonstrations.

These developments have undoubtedly caused concern in the halls of Congress and

among the US ruling class in general. The owner of the New England Patriots,

Robert Kraft, himself a Zionist, has pulled his support for Columbia

University. “I am deeply saddened at the virulent hate that continues to

grow on campus and throughout our country,” Here again, we witness how

equating Zionism with Judaism serves the interests of people like Kraft who is

worth about $12 billion.

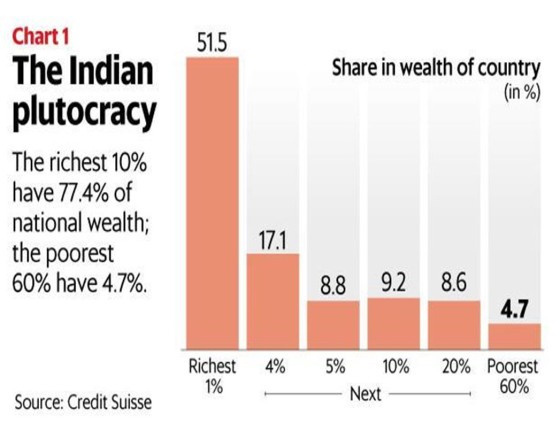

Great social upheavals tend to open up the class divisions in society and

that's what we are witnessing here. Kraft no doubt has lucrative investments in

the Middle East, probably in Israel and Arab states. Fortunately, through the

sacrifice of the Palestinian people, and the response to their resistance in

Gaza by the Zionists, claiming that the protests are ant-Jewish or that

criticism of Israel and the Zionists is anti-Semitic doesn't work any more.

As the students on the university campuses take the lead here we should recall

that the same situation existed in 1968 when the French students opened up the

floodgates of protests. Before long, some ten million French workers

ended up occupying their workplaces in what we know as the French General Strike.

There was at that time a possibility of a genuine socialist transformation of

French society leading to a wider movement to end capitalism.

I am not saying that is happening here, but the student protests will

undoubtedly have an effect on the working class and our organizations. As they

occupy campuses, the UAW, is attempting to organize more workers at the non

union plants in the US South. I think the ILWU is still in negotiations though

we wouldn't know it with the media black out and the ILWU leadership's silence

on the matter.But organized labor will not be left out in the inevitable battles with capital that are on the horizon.

Yes, we are a divided country is many ways as the right wing has made serious

headway over the past period, in my view due to the failure of the left to

respond to the offensive of capital with an offensive of our own. The trade

union leadership, the Dogs That Never Bark, as I call them, have disgracefully

done little to change the situation and will no doubt campaign for Biden in the

next few months.

It is inevitable that there will be turmoil within the ranks of organized labor

at some point in time as the anger that simmers beneath the surface of US

society rises to the top.

Let's give our support to the students on the front lines.